How to Manage the Complexity of Business Performance Improvement Initiatives: Keep It (Relatively) Simple

In today’s economy, companies are under pressure to improve business performance and to maintain financial stability. The high cost of capital and tightening profit margins of recent years have pushed many companies to reevaluate their business performance improvement strategies. Today, the focus is on the initiatives that can bring about both short-term and long-term value. This article explores the complexities of business performance improvement projects and offers a structured approach to an effective prioritization of initiatives, while maintaining the optimal risk-return equilibrium.

Insights from Capstone Partners’ Middle Market Business Owner Survey

Each year, Capstone Partners’ Market Intelligence group surveys more than 400 private middle-market business owners to gauge business priorities and strategies amid the existing economic conditions. Capstone’s 2024 Middle Market Business Owner Survey revealed the widespread impact of economic headwinds and the mitigation strategies deployed by businesses to remain in the game:

- Economic concerns: 59.2% of business owners reported that elevated inflation negatively affected their business performance. This concern was ubiquitous across all industries surveyed, underscoring the critical need for an adaptation to this new economic normality.

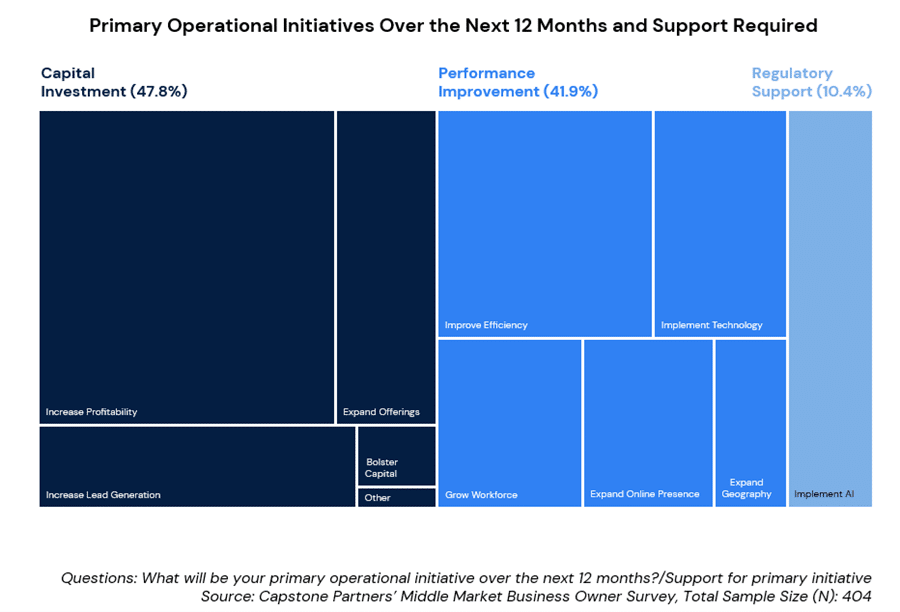

- Operational initiatives: In response to economic challenges, 28.2% of CEOs identified increasing profitability as their top priority for the next 12 months, followed by efficiency improvement (14.9%) and implementing artificial intelligence-based tools (10.4%). Businesses seem to have a dual focus on enhancing current operations while exploring new growth opportunities.

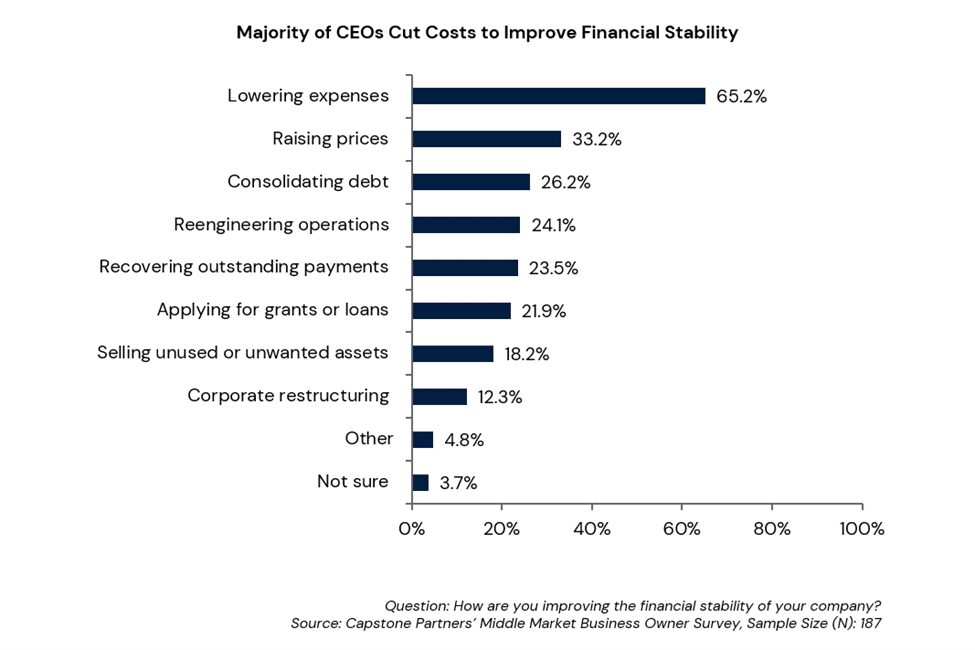

- Financial stability measures: When asked about their focus areas, 46.3% of CEOs emphasized financial stability and improving cash flow. To achieve that, 65.2% of CEOs consider lowering expenses, 33.2% plan to raise prices, and 26.2% intend to consolidate debt.

These insights paint a clear picture: businesses are actively seeking avenues to bolster performance and navigate the intricate economic terrain. However, with a multitude of options available—from pricing strategies and cost cutting to balance sheet optimization and supply chain enhancements—a pressing question arises, “Where do we begin?”

A Structured Approach to Prioritizing Initiatives

While each client situation is unique, using a methodical approach, where factors are prioritized across multiple dimensions, is an efficient way to plan and implement business performance improvement initiatives.

Three leading multi-dimensional considerations are:

- Implementation Complexity

- Implementation Timeframe

- Value of the Initiatives

By evaluating initiatives across these three dimensions, businesses can prioritize actions that offer the most benefits while having a manageable risk level and desired timeframe. This approach has proved to work well for organizations to help focus their efforts on initiatives that not only deliver high returns, but also align with their strategic objectives and available resources.

How to Evaluate Initiatives Across Each Dimension

1. Implementation Complexity

Implementation complexity encompasses several factors that can significantly influence the outcome of a business performance improvement initiative:

- Business risk: Assess the potential risks associated with each initiative. This includes market risks, operational disruptions, and potential impacts on stakeholders. For example, a major overhaul of a company’s supply chain might offer significant cost savings but could also disrupt relationships with key suppliers or lead to temporary operational inefficiencies.

- Resource requirements: Evaluate the resources—both human and infrastructural—needed for the initiative. Consider whether the organization possesses the requisite competencies or if external expertise is necessary. Also, account for the day-to-day workload of personnel to ensure they can accommodate additional responsibilities without compromising existing operations.

- Financial implications: Analyze the financial investment required for each initiative. Account for the direct costs and the opportunity costs, such as the resources that could have been allocated to other projects. For instance, investing in new technology may improve efficiency, but the upfront costs could strain cash flow needed for a warehouse expansion.

By carefully assessing these elements, businesses can categorize initiatives based on their complexity, allowing for informed decision-making. This process helps identify which projects are worth pursuing and which might pose too high a risk or demand excessive resources, thereby aligning the organization’s efforts with its strategic goals.

2. Implementation Timeframe

The implementation timeframe is another critical factor in prioritizing performance improvement initiatives. It spans from the inception of the project to the conclusion of the first reporting period, where tangible results have been validated. Several factors influence the choice of the timeframe:

- Project scope: Broader initiatives, such as a company-wide digital transformation, naturally require more time to implement. The scope of the project determines the number of stakeholders involved, the extent of changes required, the complexity and interdependencies of the tasks that need to be completed.

- Resource availability: Limited resources will elongate timelines. Make a realistic assessment of the available effective capacity to complete a project and plan accordingly.

- External dependencies. We have seen how reliance on third-party vendors or regulatory approvals added months to the project plans. For instance, integrating a new software system might depend on an external team which may be stretched on resources. Regulatory approvals are things in and of themselves, oftentimes offering little predictability of the timeline, and less probability of the outcome.

3. Value of Initiatives

While short-term effects are palatable, a comprehensive evaluation has to consider both recurring and one-time effects. The Net Present Value (NPV), a stationery in the investment analysis, has proved to be the optimal measure to compare diverse initiatives, harmonizing one-time benefits (like accounts payable optimization) with recurring gains (such as sustained cost reductions). This approach allows businesses to prioritize initiatives that offer the highest returns relative to their implementation complexity and timeframe.

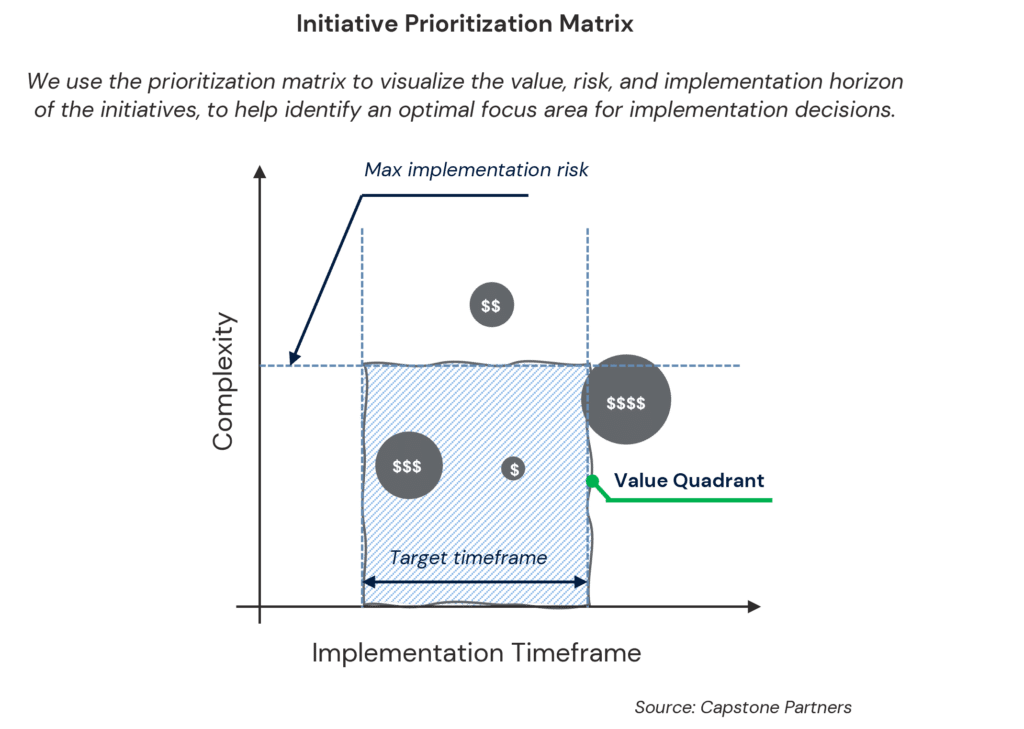

Visualizing the Prioritization Matrix

To discuss and prioritize performance improvement initiatives, a visual tool is needed. Capstone Partners’ Financial Advisory Services group suggests using a variation of a prioritization matrix—an example is a chart plotting implementation complexity on the Y-axis against implementation timeframe on the X-axis. The initiatives are plotted as bubbles, with the size of each bubble reflects the NPV of an initiative. Add two vertical lines to demarcate the boundaries for the desired implementation timeframe, and a horizontal line to indicate the threshold for acceptable implementation risk and you will get a “value quadrant,” which will provide prioritization cues. This quadrant represents the sweet spot where the benefits of the initiative outweigh the associated risks and resource requirements, making it an optimal focus area for implementation decisions.

Typically, between one and three initiatives emerge as tier one candidates, offering a strategic starting point.

Case Study: The Pitfalls of Misaligned Priorities

One of our clients reached out to us after an ambitious Enterprise Resource Planning (ERP) system overhaul started to experience difficulties. Over the course of two years, the project drained millions of dollars in costs. While it did result in better data capture and retention, it also led to increased user frustration and more convoluted reporting. Upon review, it became evident that substantial savings in working capital and pricing adjustments were attainable using the legacy ERP system. Moreover, underlying business process issues remained unaddressed in the new ERP configuration.

This example highlights the dangers of misaligned priorities and the importance of thoroughly evaluating the complexity, timeframe, and value of each initiative before committing significant resources.

By refocusing efforts, our client was able to:

- Optimize working capital using existing systems to streamline accounts receivable and payable processes, reduce inventory levels, and improve cash flow management.

- Re-engineer business processes to address suboptimal workflows and inefficient practices, making the way for sustainable productivity and operational cost improvements.

- Fine tune the ERP to create a clearer understanding of new process requirements which, in turn, allowed the ERP development team to successfully roll out an updated release that aligned with the company’s strategic objectives and operational needs.

This example underscores the significance of prioritizing initiatives and demonstrates the importance of revisiting and reassessing priorities throughout the implementation process, as new insights and challenges emerge.

10 Key Considerations for Effective Implementation

Implementing performance improvement initiatives successfully requires careful planning, execution, and monitoring. Here are several key considerations to keep in mind:

- Finding the sweet spot in timing: Prioritize initiatives that offer high returns with rapid paybacks, typically within a three-to-nine-month window. Early wins not only help alleviate financial pressures but will also boost team morale, creating a positive momentum that can carry through to more complex projects.

- Avoid high-risk, long-term projects initially: Initiatives with extended timelines (12+ months) are prone to implementation risks and will most likely require more resources and more time to implement than what was originally planned. It’s prudent to defer such projects until foundational improvements are in place, when the organization is better prepared to handle more significant challenges.

- Consider reporting period implications: Synchronize initiatives with financial reporting cycles. This alignment helps ensure that two objectives are achieved: 1). financial impact of initiatives is reflected in the company’s performance metrics and 2). success is communicated to the stakeholders in a timely fashion. If contemplating mergers or acquisitions, ensure initiatives align with transaction milestones. Integration planning helps elicit and address issues early in the process.

- Establish a risk tolerance level: start with a risk assessment scale and assign quantifiable values to each initiative. You can use any scale you like—one to three or zero to 10. This framework helps the organization prioritize initiatives based on their risk profile and ensure that decisions are made consistently and transparently.

- Implement in tiers: Break down the portfolio of initiatives into manageable tiers based on priority, complexity, and interdependencies. This staged approach allows for focused execution and resource allocation and helps reduce the risk of overextending the organizational capabilities.

- Harness data analytics: Analyze data for insights, use it to monitor trends, and predict potential challenges. Advanced analytics reveal hidden opportunities and support performance optimization—this is how you can get a competitive edge in a rapidly changing market. Your competition is probably already doing this.

- Leverage external knowledge and resources: Don’t hesitate to seek external expertise, whether through consulting firms, industry peers, or academic partnerships. Just as you borrow financial resources to grow your business, you can borrow competencies and bandwidth for short-term sprints. Such collaborations can infuse fresh perspectives and provide specialized skills that you do not need on a full-time basis.

- Monitor performance and adjust: Establish Key Performance Indicators (KPIs) to track progress. Regular reviews enable timely adjustments, ensuring initiatives stay on course and deliver expected outcomes.

- Communicate and manage change effectively: Maintain transparent communication channels with all stakeholders. Celebrate successes, address concerns proactively, and foster an environment conducive to change. Effective change management is the critical element needed to make the improvements sustainable, creating long-term organizational assets.

- Prepare for contingencies: While the focus is on executing the current plan, it’s essential to have contingency measures in place. This includes identifying potential risks and developing mitigation strategies to address them should they arise.

Conclusion

Navigating the complexities of business performance improvement projects demands a structured approach. Businesses can prioritize initiatives and manage risk by assessing implementation complexity, timeframe, and value. To become best-in-class, add monitoring, effective communication, be open to changes, and be willing to learn. Embracing this holistic approach will transform a performance improvement project from a daunting endeavor into a strategic journey toward sustained excellence.

Our Financial Advisory Services (FAS) group has significant experience helping organizations of all sizes and structures define transformative and attainable business performance improvement goals, and strategic implementation plans. For more information about how our team can help you identify and address your specific concerns, please contact us.

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.