Food Sector Mergers & Acquisitions Update – October 2024

Bifurcated Consumer Spending Favors Branded and Private Label Food Mergers and Acquisitions

Consumer behavior in the Food sector has been greatly influenced by the fickle macroeconomic environment, characterized by inflation, ballooning consumer debt balances, and a cooling job market—all of which have created bifurcated consumption patterns and robust Food merger and acquisition (M&A) opportunities in 2024. High-income consumers have showcased inelastic demand despite widespread pressures on consumer spending, upholding the health of many premium-positioned Branded segment participants and businesses with specialty product offerings. On the other hand, middle- to low-income consumers have sought value-oriented products to stretch their dollar, trading down from goods priced between value and premium to cheaper alternatives commonly found in the Private Label segment.

The Food sector has reached an inflection point as the inflation rate has declined and the Federal Reserve cut interest rates for the first time in four years. Growth in food prices has steadily decelerated to-date, increasing 2.3% year-over-year (YOY) on average in the first six months of 2024, compared to 3.5% in the final six months of 2023, according to the Bureau of Labor Statistics.1 These factors are expected to provide consumers some relief and, in turn, uplift unit volumes for both Branded and Private Label segment participants.

The Food sector has experienced increased M&A activity in the Branded segment to-date with strategic and financial acquirers finally reaching valuation alignment with target companies. Concurrently, Private Label companies have continued to garner strong buyer interest and are projected to increasingly focus on consolidation as the U.S. market for private label goods matures. The sector-wide M&A outlook remains positive and major players have signaled appetite for inorganic growth to strengthen sales volumes and capture wallet share moving into 2025.

We are seeing an unprecedented bifurcation in the consumer that is largely mirroring the broader socioeconomic climate. A significant portion of the population are buying primarily based on price, while more affluent consumers are purchasing premium and specialty food products despite elevated prices lingering from the recent inflationary period that we experienced. In terms of retail trends, Walmart and Aldi, in particular, are distinguishing themselves in the value sector, while Costco is also doing well given their mix of shoppers that seek both quality and attractive prices.

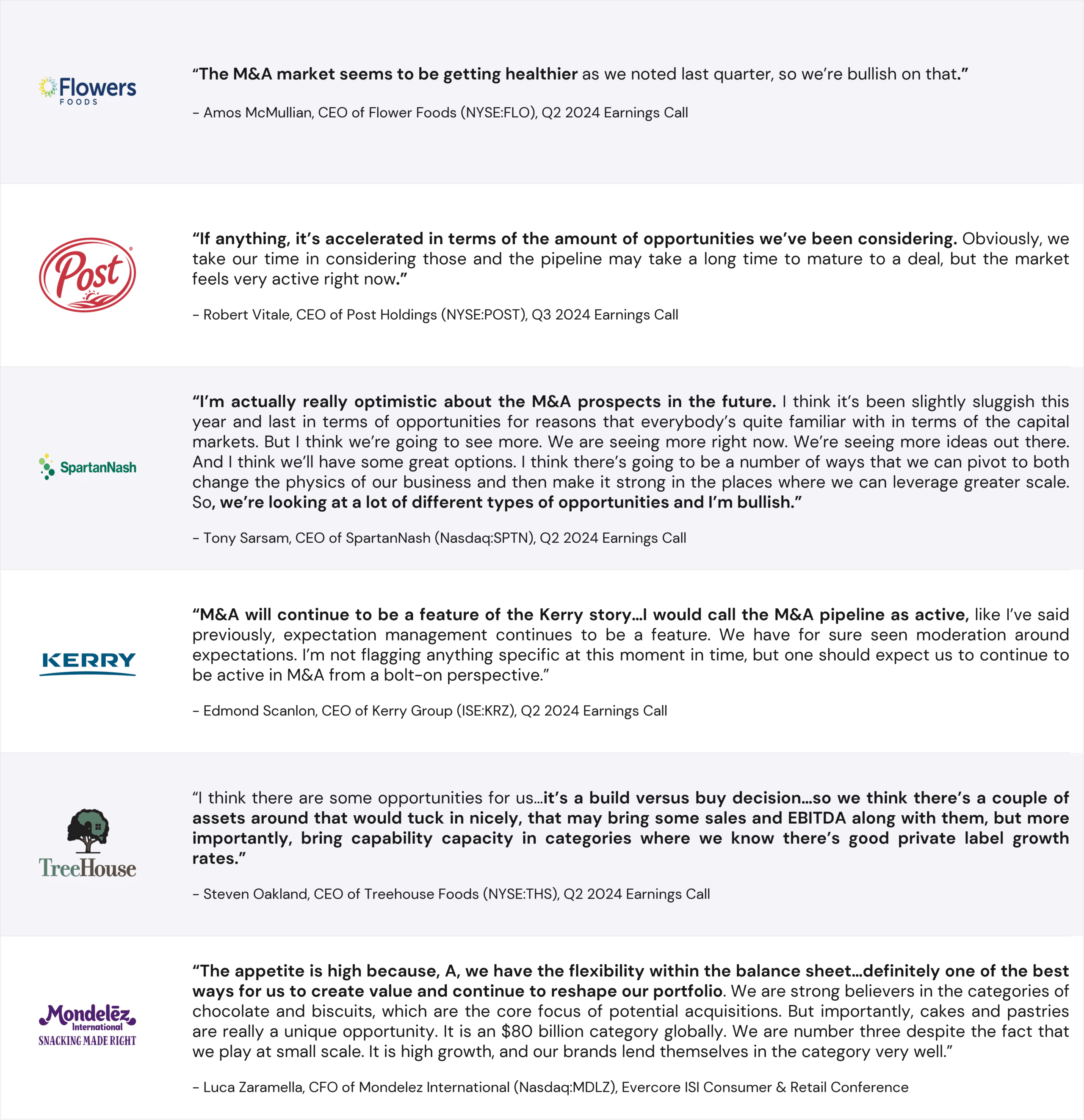

Public Players Signal Accelerating M&A Market

Source: Company Earnings Calls, Event Transcripts, and Capstone Partners

Food Sector Mergers & Acquisitions Activity Increases, Buoyed by Branded Segment

Deal activity in the Food sector experienced growth through year-to-date (YTD), rising 5.3% YOY to 180 transactions announced or completed. Strategic buyers have exercised caution to-date, with transaction volumes rising slightly (0.9%) compared to the prior year period. Private businesses have continued to trade, tallying 86 deals compared to 80 in YTD 2023. Public strategic acquisitions declined from 29 deals in YTD 2023 to 24 transactions in YTD 2024 as some firms have enacted disciplined capital allocation strategies focused on maintaining investment-grade balance sheets, organic growth initiatives, and returning cash to shareholders via dividend increases and share buybacks. As these firms cycle through operational initiatives and more quality assets come to market, public players will likely pursue M&A more aggressively. However, subdued strategic activity has been more than offset by fervent appetite from private equity groups. Platform deals have increased 17.4% YOY (27 platform formations in YTD 2024) and sponsor-backed acquisitions have risen 10.3% YOY to 43 transactions.

Notably, both strategic and financial buyers have expressed a growing appetite for acquisitions in the Branded segment. This segment has experienced the highest level of transaction activity among Food sector M&A, contributing 86 deals to the sector’s total deal volume to-date. Private equity buyers have announced or completed 21 add-on transactions and 14 new platforms in the segment. Furthermore, both Branded Fresh and Shelf-Stable sub-segment companies have been a focal point for sponsor activity, comprising 24.3% and 22.9% of total private equity deals in YTD, respectively. Consolidations among strategic players in the Branded space have accelerated, with 51 private or public transactions announced or completed in YTD 2024 compared to 41 in the prior year period.

A settling of valuation expectations has helped drive the sharp YOY increase in Branded segment M&A volume. Prior to 2020, acquirers paid historically premium valuations for high-growth, branded companies that were well-positioned to meet rising consumer demand for clean label, healthy, organic, authentic brands. Between 2018 and 2023, volatile consumption preferences, pandemic-induced supply chain disruptions, and interest rate hikes caused both strategic and financial buyers to shy away from dealmaking in the segment, particularly as seller valuation expectations remained unjustly high. However, as sellers have lowered their valuation expectations to match market demand in YTD 2024, deal volumes in the Branded segment have rebounded. The recovery in dealmaking has been greatly influenced by private equity buyers, who have closed or announced more Branded segment transactions to-date (35) than in full-year 2023 (27) and 2022 (18). Additionally, sponsor activity has accounted for an increasing percentage of segment deal volume over the three-year period, comprising 29% of Branded transactions in 2022, 32.1% in 2023, and 40.7% in YTD 2024. Despite seller valuation expectations falling, Branded segment transaction multiples have remained healthy. The segment has seen companies trade hands at an average EBITDA multiple of 16.4x between 2023 and YTD—a premium to the Distribution and Processing segments’ combined average of 15.9x.

The outlook on Branded segment dealmaking appears positive. Consumer preferences have shifted back towards pre-pandemic consumption trends, which favors Branded, Better-For-You (BFY) companies. “We feel really good about what we’re seeing with consumer behavior coming back into natural products. Those that would have followed BFY pre-COVID, you would have seen Natural categories outpace Conventional categories. Then, in COVID it reverted, and we heard all of the demise of BFY, nobody is going to buy BFY anymore…We’re now seeing in the Circana data that natural products are coming back across certainly the categories that we’re in,” noted Wendy Davidson, CEO of Hain Celestial (Nasdaq:HAIN), at the Barclays Global Consumer Staples Conference.2 Capstone expects Branded M&A to continue its momentum into 2025, as business owners that previously postponed a sale re-engage efforts to pursue an exit.

U.S. Private Label Manufacturers Offer Significant Runway for Food M&A

As a result of sticky inflationary pressures, a shift in consumer preferences towards value has accelerated Processing segment M&A opportunities for private label manufacturers. Notably, U.S. Private Label General Food dollar sales grew 10% YOY in 2023 to $42.6 billion, according to the Private Label Manufacturing Association.1 However, within total grocery sales in 2023, U.S. Private Label General Food only accounted for 15.4% of total dollar share or 18.7% of unit share, according to PDG Insights.4 This was markedly below private label penetration in the top six European countries, where private label products comprise nearly 40% of annual grocery sales. The rise of private label sales in the U.S. can be seen through recent launches from Grocery Outlet (Nasqaq:GO) and Walmart (NYSE:WMT). In September, Grocery Outlet launched a private label program, GO Brands, which included 100 stock-keeping units (SKUs), available across its 520 locations by the end of 2024, according to a press release.5 In the program, the SimplyGO brand will offer high-quality grocery and beverage items. In April, Walmart launched a new private label food brand, bettergoods, the firm’s largest private label food launch in 20 years, according to a press release.6 The brand is expected to deliver direct alternatives to National Brand products, as well as new unique offerings that expand flavors and concepts. With value positioning, products feature competitive pricing, ranging from under $2 to under $15, with most products under a $5 price point. New products include offerings catering to plant-based items and different dietary lifestyles, such as gluten and dairy-free. Retailers are projected to continue launching private label initiatives due to their positive impact on margins.

The Private Label subsegment has also been attractive from a financial sponsor perspective, as platforms build symbiotic relationships with leading retailers, rather than competing for shelf space as adversaries. As a result, private label companies have taken increasing share of total Processing segment deal activity. During 2023, private label transactions comprised a record percentage (29.5%) of deal volume in the Processing segment and transaction volumes have climbed 11.8% YOY in YTD 2024. Capstone expects the category to garner increased interest as strategics consolidate the fragmented U.S. market and private equity buyers look to establish platforms and execute roll-up strategies amid a lack of scaled players.

Select transactions from the wide-ranging segments of the Food sector are highlighted below:

- Mars to Acquire Kellanova (August 2024, $35.8 Billion, 2.8x EV/Revenue, 17.6x EV/EBITDA) - Mars, a global snacking company whose brand portfolio includes Snickers, M&Ms, Twix, and Kind, announced its acquisition of snack company Kellanova (NYSE:K) for an enterprise value of $35.8 billion, equivalent to 2.8x EV/Revenue or 17.6x EV/EBITDA (August 2024). Kellanova’s brand portfolio includes Pringles, Cheez-It, Pop-Tarts, Rice Krispies Treats, NutriGrain, RxBar, Eggo, and MorningStar Farms. With Kellanova’s reach in 180 markets and robust brand portfolio, the deal accelerates Mars’ ambition to double Mars Snacking—its Snack division—in the next 10 years, according to a press release.7 “The Kellanova brands significantly expand our Snacking platform, allowing us to even more effectively meet consumer need and drive profitable business growth. Our complementary portfolios, routes-to-market and research and development capabilities will unleash enhanced consumer-centric innovation to shape the future of responsible snacking,” said Andrew Clarke, Global President of Mars Snacking, in the press release.

Mars’ focus on acquiring scale, expanding into new categories, and shifting away from confectionary goods, has also been seen in two other large-scale public transactions across the sector in late 2023. Snack conglomerate, The J.M. Smucker Company (NYSE:SJM) acquired sweet baked snack producer, Hostess Brands, for an enterprise value of $5.6 billion, equivalent to 4.1x EV/Revenue or 18.5x EV/EBITDA (September 2023). Additionally, Campell Soup Company (NYSE:CPB) acquired Sovos Brands, whose brand portfolio includes Rao’s and Micheal Angelo’s, for an enterprise value of $2.8 billion, equivalent to 3.0x EV/Revenue or 15.7x EV/EBITDA (August 2023).

- Performance Food Group to Acquire Cheney Bros (August 2024, $2.1 Billion, 0.7x EV/Revenue, 13.0x EV/EBITDA) – Leading food distributor, Performance Food Group (NYSE:PFGC), announced its acquisition of broadline foodservice distributor Cheney Bros for an enterprise value of $2.1 billion, equivalent to 0.7x EV/Revenue or 13.0x EV/EBITDA (August 2024). The deal marks expansion PFG’s expansion into key Southeastern U.S. markets. The company expects the acquisition to generate $50 million of net annual run-rate cost synergies by the third year upon completion and have an accretive impact on Adjusted Diluted EPS by the end of the first year, according to a press release.8 “This acquisition will expand and enhance our offerings to a high-quality and diverse customer base. We have long admired the success of Cheney Brothers in the Southeastern U.S. and believe that the combination of our organizations will push the business to new heights,” saif George Holm, CEO of Performance Food Group, in the press release.

- Manna Tree Acquires Controlling Stake in Verde Farms (July 2024, Undisclosed) – Private equity firm, Manna Tree, has taken a controlling interest in Verde Farms, a producer of organic, 100% grass-fed, pasture-raised beef, for an undisclosed sum (July 2024). With a vertically integrated business model, the company offers its products under the Verde brand, which is available at major retailers such as Amazon Fresh and Albertsons, as well as through co-manufacturing partnerships. The announcement follows Manna Tree’s initial investment (February 2020, $15 million) which helped fund Verde’s channel and geographic expansion, new product development, brand promotion, and operational capacity. “I’m particularly excited about building on our recent successes, including our strong velocities and significant increases in store count and distribution points… We will also focus on delivering innovation to the consumer, through new products that make it even more convenient to add delicious, healthy protein to their menus,” said Brad Johnson, CEO of Verde Farms, in a press release.9

- Swander Pace Capital Acquires Inovata Foods (June 2024, Undisclosed) – In June 2024, U.S.-based Swander Pace Capital (SPC), a consumer products-focused private equity firm, acquired Inovata Foods, a manufacturer of private label frozen entrees for an undisclosed sum. The transaction represents SPC’s seventh active platform in the Food & Beverage space. Notably, SPC’s other investments all comprise pure-play branded companies or businesses with both branded and private label offerings, making Inovata Foods its first pure-play private label platform. “As the demand for premium private label meal solutions continues to grow, we see Inovata as the ideal platform to capitalize on these trends. With extensive experience in private label and food manufacturing throughout North America, we believe we are uniquely positioned to help foster Inovata’s growth and leadership position in the industry,” said Tyler Matlock, Managing Director at SPC, in a press release.10

- Cal-Maine Foods Acquires ISE America (June 2024, $112 Million) – Cal-Maine Foods (Nasdaq:CALM), a shell egg and egg products producer, acquired ISE America for $112 million (June 2024). The acquisition of ISE America includes, its commercial shell egg production and processing facilities, 4,000 acres of land, current inventory, an egg products breaking facility, and its customer distribution network. Notably, ISE ranks as the 23rd largest U.S. egg producer by number of hens, with 4.7 million hens, according to Egg Industry.11 The acquisition bolsters Cal-Maine’s market leading production capabilities as the top egg producer in the U.S. The deal also underscores Cal-Maine’s M&A strategy in which targets must bolster its production capacity and reduce the gap between dozens produced and dozens sold and expand cage-free production capabilities in key markets. “We are excited about the opportunity to significantly enhance our market reach in the Northeast and Mid-Atlantic states with the acquisition of these assets from ISE. The added production and distribution capabilities will allow us to serve new customers and expand capacity, particularly in the Northeast, which is largely a new territory for Cal-Maine Foods,” said Sherman Miller, CEO of Cal-Maine Foods, in a press release.12 The firm continues to see an active pipeline of M&A opportunity due to generational turnover and investment requirements for cage-free egg production, according to its fiscal year Q4 2024 investor presentation.13

- Lassonde Industries Acquires Summer Garden Food Manufacturing (June 2024, $280 Million, 1.9x EV/Revenue, 10.0x EV/EBITDA) – Lassonde Industries (TSX:LAS.A), Canadian producer of ready-to-drink (RTD) beverages, fruit-based snacks, and frozen juice concentrates, acquired U.S.-based Summer Garden Food Manufacturing for $280 million, equivalent to 1.9x EV/Revenue or 10.0x EV/EBITDA (June 2024). In addition to providing co-packing services for well-known and growing brands in the space, Summer Garden Food Manufacturing, under its company-owned brands, produces specialty food products, including premium pasta sauces and a range of sugar-free sauces and condiments. Summer Garden Food Manufacturing offers 250 products sold in more than 20,000 locations across the U.S., according to Lassonde’s September investor presentation.14 The margin and earnings accretive transaction nearly doubles Lassonde’s market presence in specialty food and significantly expands its reach in the U.S. market. Moreover, the firm also cited manufacturing synergies in retort processed products, access to adjacent categories, and future cross-selling opportunities as key to the deal rationale.

To discuss Branded or Private Label opportunities in the Food market, provide an update on your business, or learn about Capstone's wide range of advisory services and Food mergers & acquisitions knowledge, please contact us.

Andrew Woolston, Associate, was the lead Market Intelligence contributor to this article.

Endnotes

-

Bureau of Labor Statistics, “Consumer Price Index Summary”, https://www.bls.gov/news.release/cpi.nr0.htm, accessed September 6, 2024.

-

Hain Celestial, “Presenting at the Barclays Global Consumer Conference 2024,” https://event.webcasts.com/starthere.jsp?ei=1685185&tp_key=e971285cc0&tp_special=8, accessed September 9, 2024.

-

Private Label Manufacturers Association, “PLMA’s 2024 Private Label Report,” https://plma.com/sites/default/files/files/2024-02/yearend-report2024-final.pdf, accessed September 5, 2024.

-

PDG Insights, “America’s True Big Brand: A Peak at the True Private Label Opportunity,” https://www.pdginsights.com/post/a-peak-at-the-private-label-brand-opportunity, accessed September 5, 2024.

-

Grocery Outlet, “Grocery Outlet Launches Private Label Program, Go Brands,” https://investors.groceryoutlet.com/news-releases/news-release-details/grocery-outlet-launches-private-label-program-go-brands, accessed September 5, 2024.

-

Walmart, “Walmart Launches bettergoods, a New Private Brand Making Elevated Culinary Experiences Accessible for All,” https://corporate.walmart.com/news/2024/04/30/walmart-launches-bettergoods-a-new-private-brand-making-elevated-culinary-experiences-accessible-for-all, accessed September 5, 2024.

-

Mars, “Mars to Acquire Kellanova,” https://www.mars.com/news-and-stories/press-releases-statements/mars-acquisition-august-2024, accessed September 9, 2024.

-

Performance Food Group, “Performance Food Group Company Announces Agreement to Acquire Cheney Bros, Inc.,” https://investors.pfgc.com/press-releases/press-release-details/2024/Performance-Food-Group-Company-Announces-Agreement-to-Acquire-Cheney-Bros-Inc/default.aspx, accessed September 11, 2024.

-

PR Newswire, “Manna Tree Takes Controlling Interest In Verde Farms, Positioning Leader in Organic, Grass-Fed, Beef for Accelerated Growth,” https://www.prnewswire.com/news-releases/manna-tree-takes-controlling-interest-in-verde-farms-positioning-leader-in-organic-grass-fed-beef-for-accelerated-growth-302203485.html, accessed September 9, 2024.

-

Swander Pace Capital, “Wander Pace Capital Partners with Inovata Foods,” https://spcap.com/announcement/swander-pace-capital-partners-with-inovata-foods/, accessed September 9, 2024.

-

Egg Industry, “The Largest US Egg-Producing Companies of 2024,” https://www.eggindustry-digital.com/eggindustry/library/item/january_2024/4160285/, accessed September 9, 2024.

-

Business Wire, “Cal-Maine Foods, Inc. Announces Acquisition of Egg Production Assets of ISE America, Inc.,” https://www.businesswire.com/news/home/20240628433127/en/Cal-Maine-Foods-Inc.-Announces-Acquisition-of-Egg-Production-Assets-of-ISE-America-Inc., accessed September 9, 2024.

-

Cal-Maine Foods, “4Q & YE2024 Investor Presentation,” https://irp.cdn-website.com/79e86203/files/uploaded/FY_2024_-_4Q_-_YE_Investor_Presentation_Finalv2.pdf, accessed September 9, 2024.

-

Lassonde Industries, “Introduction to Lassonde Summer 2024,” https://www.lassonde.com/content/uploads/2024/09/Lassonde-presentation_September-2024-ENG.pdf, accessed September 9, 2024.

Related Transactions

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.