Getting the Most from a Quality of Earnings Review

What is a Quality of Earnings Review?

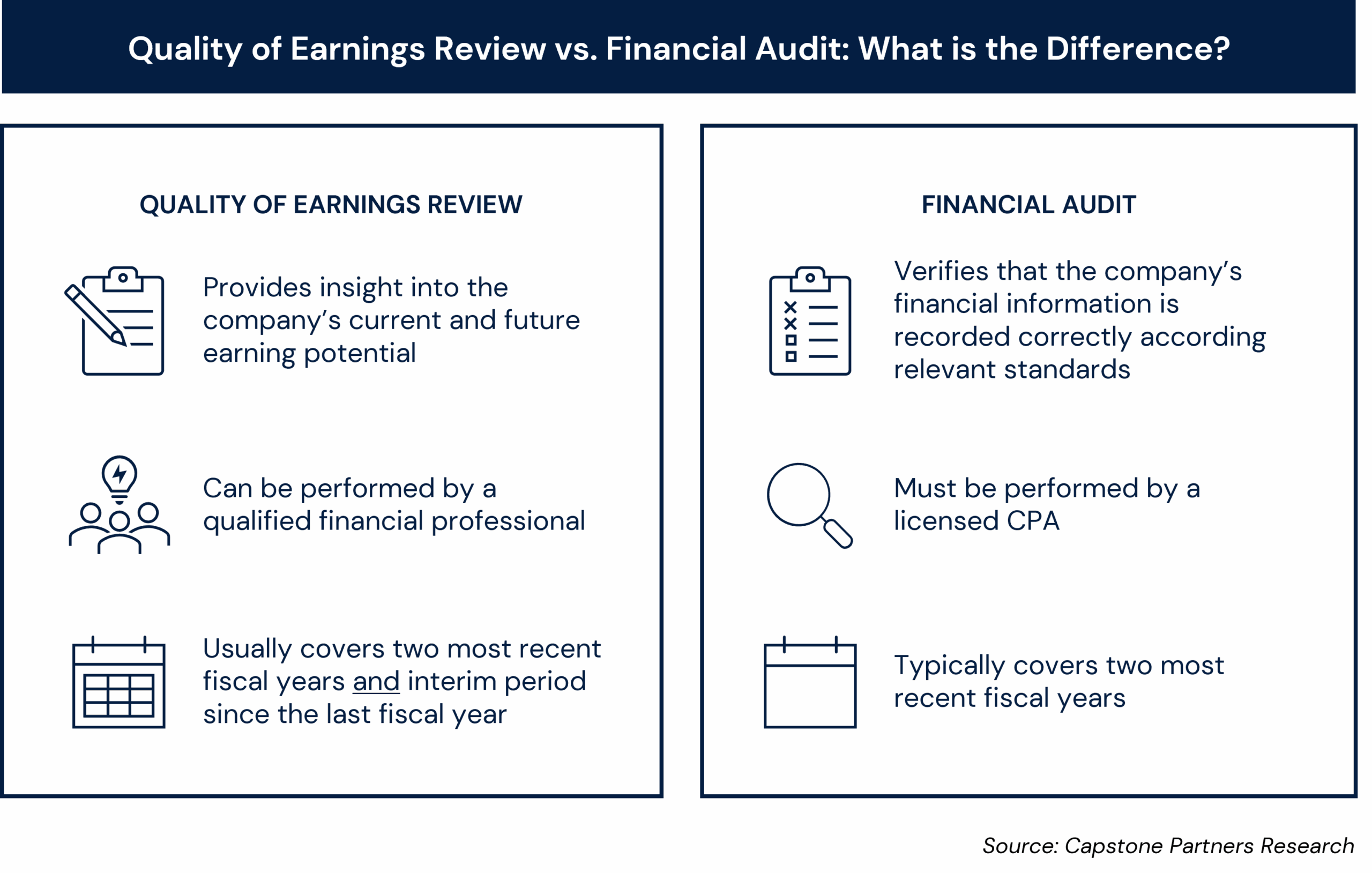

Transaction-related due diligence is a broad process that can shift in scope based on transaction size and the situation, as well as whether one is conducting it on behalf of a seller or a buyer. However, many financial due diligence assignments, both buy-side and sell-side, include a step called the Quality of Earnings Review, or QofE. While not the same as an annual financial audit, the goal of the QofE is to examine a company’s historical financial results and analyze and validate the pro forma EBITDA at normalized levels to support the purchase price/valuation of the transaction target.

About the QofE Process

On the sell-side of a transaction, a QofE review may be recommended by the investment banking team, advising the seller to help accelerate the pre-letter of intent (LOI) deal process to alleviate financial due diligence concerns and shorten the timeline of post-LOI confirmatory due diligence. The review can also bring to light any potential challenges that could arise during confirmatory due diligence that will need to be addressed and quantify the highest defensible adjusted EBITDA number for valuation purposes.

On the buy-side of a transaction, the review’s audience is typically a potential buyer, investor, or lender who uses the findings in the review to ultimately validate the assumptions used to determine the valuation/purchase price of a prospective transaction. In these situations, Capstone’s Financial Advisory Services (FAS) team is engaged directly by a private equity group, lender, or a strategic buyer to conduct the QofE review process and provide our expert evaluation.

In a typical buy-side process, Capstone’s FAS team provides the target a request list of historical financial and accounting records and begins our analysis as soon as we start receiving this information. The advisory team’s first goal is to look at the target’s communicated adjusted EBITDA and validate the assumptions and support that were used to arrive at that number.

We will also conduct a Trend Analysis on the target’s financial statements and trial balances to identify any abnormalities and report on the likely causal factors (a global pandemic starting in March of 2020, for example) to provide the review user with complete visibility into the company’s performance over the examined period. As we review the records, we follow up with a series of management calls to help clarify the details. Our process is designed to provide the most accurate picture of the target company to aid the user in their final assessment of the investment.

High Volume of M&A Activity Driving Demand for Quality of Earnings Reports

We’re seeing a high demand for QofE reports right now, along with other due diligence related procedures—all connected to the record volume of overall merger and acquisition (M&A) activity.

The value of the QofE analysis on both the buy-side and sell-side of the transaction is particularly apparent in the middle market, where businesses do not always have the most robust or sophisticated financial systems and infrastructure. Capstone’s FAS team has a wealth of experience in helping to bridge the gap between a company’s existing financial statements, which are adequate for day-to-day operations, and the type of detail that is needed to stand up to the scrutiny that a buyer or lender brings during a transaction.

Choosing a Quality of Earnings Provider

Working with Capstone Partners’ FAS team to complete a QofE review offers our clients some unique benefits:

- Price: Capstone’s fee structure is optimized for the middle market and is favorable relative to the large accounting firms for the same scope of work. Many of our transaction advisory professionals have significant Big Four CPA firm experience, our review procedures are consistent with best practices at those firms, and our work products are superior in their usability compared to those accounting firms.

- Value and Experience: Our professionals have extensive background conducting financial due diligence processes in conjunction with transactions, across most major industry sectors. As a result, Capstone’s analyses often contain more usable information than many of our competitors regarding the “why” behind the “what” in the review. We have heard from clients that this level of insight has improved their decision making and helped lead to better outcomes.

- Timing: We know that speed to market is an essential element in most transactions. A thoughtful and detailed due diligence process should not be a bottleneck. We work with our valued clients to make sure we provide them with the insights they need, as quickly as possible to help keep processes moving forward.

If You Have Questions

Capstone’s Financial Advisory Services group has deep professional experience providing clients with comprehensive transaction support in addition to a range of other advisory services. If you have any questions about how to get the most out of your financial due diligence process either as a buyer, a seller, or in your role as a business advisor, please reach out to us for help.

Related Transactions

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.