Middle Market Leveraged Finance 2021 Report

Lenders Increase Leverage to Win Middle Market Transactions in Robust M&A Environment

Lenders Increase Leverage to Win Middle Market Transactions in Robust M&A Environment

Capstone Partners released its Middle Market Leveraged Finance 2021 Report, providing key statistics on the Credit markets along with analysis and observations from Capstone’s Debt Advisory Group.

Note: For updated statistics, please refer to our 2022 report.

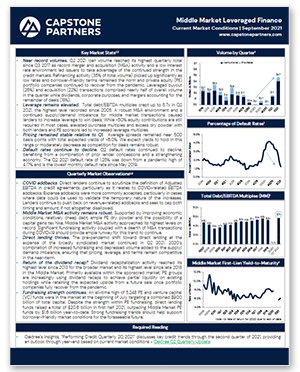

Loan volume in Q2 2021 reached its highest quarterly total since Q3 2017 as record merger and acquisition (M&A) activity and a low interest rate environment led issuers to take advantage of the continued strength in the Credit markets. Refinancing activity (35% of total volume) picked up significantly as low rates and borrower-friendly terms remained the norm and private equity (PE) portfolio companies continued to recover from the pandemic. Leveraged buyout (26%) and acquisition (22%) transactions comprised nearly half of overall volume in the quarter while dividends, corporate purposes, and mergers accounting for the remainder of deals (18%).

Total debt/EBITDA multiples crept up to 5.7x in Q2 2021, the highest level recorded since 2005. A robust M&A environment and a continued supply/demand imbalance for middle market transactions caused lenders to increase leverage to win deals. While ~50% equity contributions are still required in most cases, elevated purchase multiples and excess dry powder with both lenders and PE sponsors led to increased leverage multiples.

Also included in our Middle Market Leveraged Finance 2021 report:

- What COVID addbacks direct lenders are commonly accepting.

- Why dividend recapitalization activity has reached its highest level since 2018.

- Why the pre-pandemic shift toward direct lending has continued in Q2 2021.

- How strong fundraising trends should help support borrower friendly market conditions for the foreseeable future.

Related Transactions

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.