Middle Market Business Owners Survey – 2024

Capstone Business Owners Survey Finds CEOs Focus on Performance Improvement, Turn to Capital Market Growth in High Interest Rate Environment

Capstone Partners has released its 2024 Middle Market Business Owners Survey Report, with insights from privately-owned companies across the U.S. This report combines Capstone’s in-depth middle market knowledge with proprietary data obtained from 404 participating owners of privately held, middle market companies. Capstone surveyed middle market business owners across industries in the U.S. between July 31, 2024, and August 26, 2024. The full report, available for download below, evaluates the health and progress of the middle market in 2024, with sections including 1). State of Business & Decision Making, 2). Growth, Financial, & Exit Planning, and 3). Revenue Impacts, Forecasts, & Economic Outlook. The report also reveals data by industry, company size, and revenue generated, highlighting statistically significant variances.

Inflation Remains a Headwind, Interest Rates Key Concern

The U.S. has endured a structurally higher interest rate environment since 2020 to combat elevated inflation, which has challenged more than half (59.2%) of middle market business owners surveyed in 2024. The share of owners afflicted by heightened interest rates increased 5.1% year-over-year (YOY), rising to the second most prominent hurdle. Meanwhile, hiring concerns fell 8.4% YOY amid a softening labor market.

Among CEOs concerned with inflation/interest rates, the majority (60.8%) have accounted for the higher-for-longer interest rate environment by reducing business expenses, followed by identifying potential business vulnerabilities (48%). While the Federal Reserve’s 50 basis point interest rate cut in September will likely provide some relief on borrowing costs, business owners may not see the direct impacts until further cuts are implemented.

CEOs Weigh Impact of a Party Change in the White House

The result of the 2024 U.S. Presidential election is slated to have a significant effect on the private sector, including middle market businesses. Based on our survey findings, the lion’s share (42.5%) of CEOs indicated that a party change in the White House (from Democrat to Republican) would have a positive impact on business operations. While a political party change was deemed positive across most business demographics, operators of larger companies (100+ employees) felt stronger about the positive impacts of a party change compared to smaller business owners. Regardless of CEOs’ political stance, the vast majority cited macroeconomic issues as the most important factor in the 2024 election.

Owners Raise Equity to Spur Growth and Secure Liquidity

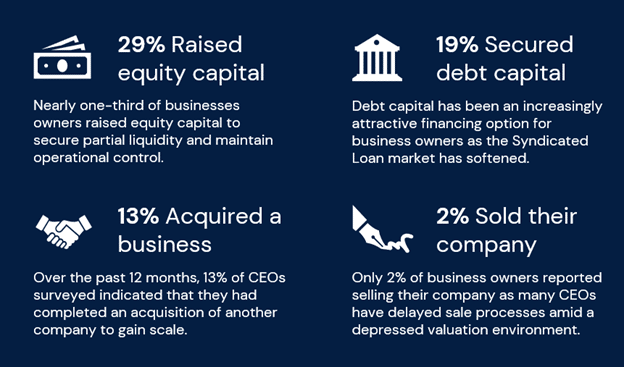

Many business owners have turned to the capital markets to prompt growth, ensure financial stability, and secure personal liquidity amid economic turbulence. Of note, 44.1% of CEOs surveyed completed at least one capital markets transaction over the last 12 months. The lion’s share (28.7%) of business owners surveyed raised equity capital, followed by debt capital (18.6%). In addition, 13.4% of CEOs completed an acquisition of another company and only 2.2% sold their business.

Taking on a minority stake equity investment can be an effective strategy for CEOs looking to source capital without ceding operational control of the company. Additionally, a minority stake equity investment can enable a business owner to pursue a two-step sell-side process. In this process, the owner receives liquidity for a portion of their ownership stake and can then seek a full liquidity event once the business reaches a more mature margin and revenue profile.

CEOs’ Capital Markets Activity Over the Last 12 Months – 2024 Business Owners Survey

Question: Which of the following business strategies have you enacted over the last 12 months?

Source: Capstone Partners’ Middle Market Business Owner Survey, Total Sample Size (N): 404

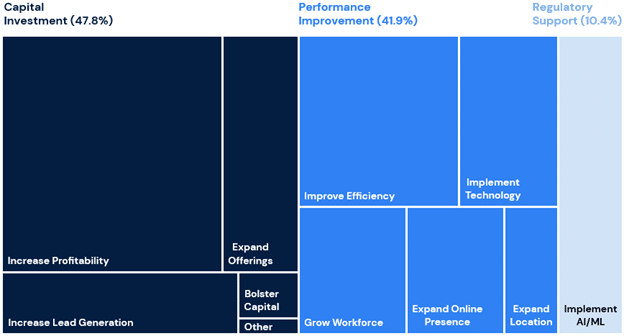

Performance Improvement Support Becomes Increasingly Critical

Reaching or enhancing profitability has been increasingly prevalent for CEOs amid an elevated interest rate environment. Of note, increasing profitability is among the top operational initiatives for middle market business owners over the next 12 months, as noted by 28.2% of CEOs surveyed. Improving efficiency and implementing artificial intelligence/machine learning tools will also be pertinent operational initiatives for 2025, as identified by 14.9% and 10.4% of owners, respectively. Among total business owners surveyed, the lion’s share (47.8%) emphasized capital investment as the most useful resource in support of their primary operational initiative, followed by performance improvement support (41.9%) and regulatory support (10.4%). The share of business owners that require performance improvement support increased 17.1% compared to the prior year as CEOs have been under pressure to maintain financial stability amid heightened inflation and a difficult operating environment.

Primary Operational Initiatives Over the Next 12 Months and Support Required

Questions: What will be your primary operational initiative over the next 12 months?/Support for primary initiative

Source: Capstone Partners’ Middle Market Business Owner Survey, Total Sample Size (N): 404

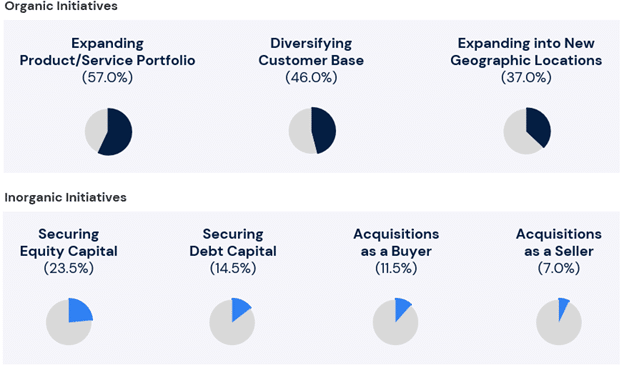

Owners to Pursue Organic Growth and Equity Capital, Require Growth Strategy Support Services

Nearly half (49.5%) of 2024 Business Owners Survey respondents plan to execute growth strategies over the next 12 months to capture additional market share and gain scale in preparation for a market rebound. CEOs have increasingly pursued growth measures that allow them to expand the business while maintaining operational control. Among CEOs planning growth strategies, most have prioritized organic initiatives including expanding offerings (57%), diversifying customer bases (46%), and penetrating new geographies (37%). While organic measures can support revenue growth, inorganic growth practices have remained a key strategic option to expedite expansion. Of note, 23.5% of business owners plan to raise equity capital over the next 12 months. Merger and acquisition (M&A) transactions have also remained prevalent, although the share of CEOs planning a buy-side or sell-side venture declined YOY. However, continued interest rate cuts may spur a frothier M&A market than expected.

CEOs’ Top Growth Strategies for 2024

Question: Which of the following growth strategies are most important to prioritize over the next 12 months?

Source: Capstone Partners’ Middle Market Business Owner Survey, Sample Size (N): 200

Based on our data, financial services demand has been directly tied to business owners’ primary initiative over the next 12 months. Of note, the lion’s share (40.7%) of owners anticipate a need for growth strategy support services to facilitate organic and inorganic expansion. Similarly, 38.1% of CEOs require equity capital advisory services to support operational initiatives and business expansion plans. Nearly one-third of owners need accounting and audit support to shore-up cash flows and establish financial stability. In addition, 30.2% of CEOs demonstrated an interest in accessing relevant industry research to keep up with emerging industry trends, complete competitor analyses, and track capital markets activity in their space.

Exit Preparation Lends to Higher CEO Confidence

The middle market has demonstrated a need for succession planning as 37.9% of CEOs surveyed in 2024 indicated they have yet to start planning a business exit. Our data shows a strong correlation between business owners’ exit readiness and their confidence that the company would remain viable a year from now if they left it tomorrow. Among CEOs who have started to prepare for a business exit, 83.2% feel confident that the business would remain viable in one year upon their immediate departure. In contrast, only 47.7% of owners who have yet to start exit planning feel confident in their business’ viability. Additionally, of the 32 respondents planning to engage in an acquisition over the next year, only 13 stated they have an investment banker in place. Investment banks offering M&A advisory services act as a partner to business owners throughout an acquisition process, leveraging industry knowledge to achieve the client’s goals. Starting the dialogue sooner rather than later is always best practice when seeking assistance from an M&A advisor as the preparation prior to an acquisition typically takes two to three years.

Question: What steps have you taken to prepare for a future exit?

Source: Capstone Partners’ Middle Market Business Owner Survey, Total Sample Size (N): 404

2024 Business Owners Survey Shows Strong Correlation Between Revenue Growth and Outlook

While many factors can influence a business owner’s industry outlook, there has been a strong correlation between revenue growth and industry optimism among the CEOs surveyed. Notably, the Business Services and Building Products & Construction Services industries showcased the highest YOY increase of business owners feeling very or somewhat positive on the state of their industries over the next 12 months, rising 22.2% and 12%, respectively. CEOs in these industries also comprised the highest increase of business owners reporting YOY revenue gains. In 2024, the share of Business Services respondents reporting revenue growth increased 21.2% YOY. Similarly, the share of CEOs reporting revenue gains in the Building Products & Construction Services industry rose 12% compared to 2023. However, the majority of business owners in nearly all (12 out of 14) industries surveyed reported a very or somewhat positive outlook on the state of their respective industries—demonstrating widespread optimism for 2025.

The bulk of CEOs surveyed have enjoyed modest YOY revenue growth in 2024, with 38.1% and 21.8% of owners reporting revenue increases between 1-9% and 10-25%, respectively. Similarly, 33.2% of CEOs project 2025 revenues to rise 1-9% YOY, and 34.2% expect revenue growth of 10-25%, indicating steady near-term sales growth among many middle market businesses. At an industry level, there were six industry groups in which more than 70% of owners reported YOY revenue gains in 2024, led by the Industrial Technology, Business Services, and Transportation, Logistics & Supply Chain industries. Looking ahead, the majority of CEOs in each industry surveyed have forecasted YOY sales growth for 2025, led by the Industrial Technology and Transportation, Logistics & Supply Chain industries.

Inflationary headwinds, elevated interest rates, and political uncertainty surrounding the 2024 U.S. Presidential election have negatively affected business owners’ economic outlook over the next 12 months. The share of CEOs with a very positive U.S. economic outlook has declined each year since 2021—falling to 15.3% in 2024. However, the lion’s share (44.3%) of business owners in 2024 reported a very or somewhat positive outlook on the U.S. economy over the next 12 months, nearly matching 2023 levels (44.2%). This indicates that CEOs have maintained a cautious economic position, with many of the middle market business owners surveyed demanding a change of administration and new economic policy to alleviate inflationary pressures and fortify balance sheets.

We see this as important work, and we need your help. If you are the owner of a privately held company in the United States, we kindly ask you to volunteer for our study.

Download the Full Business Owners Survey Report Publication

Use this form to gain access to our full 2024 Middle Market Business Owners Survey, with an in-depth analysis of survey responses broken down by industry, and sign up to participate in our 2025 study:

Max Morrissey, Vice President, was the lead Market Intelligence contributor to this report.

Insights for Middle Market Leaders

Receive email updates with our proprietary data, reports, and insights as they’re published for the industries that matter to you most.