Capstone Partners, advised SPG on its partnership with Ridgemont Equity Partners (Ridgemont).

We take great pride in delivering the highest quality therapeutic and behavior intervention services. Special needs children deserve nothing less and we are committed to developing, mentoring, supporting, and training highly passionate clinicians who are in the front lines in helping children with autism and learning disabilities succeed. Our partnership with Ridgemont will not only allow us to expand geographically but also offer new treatment modalities to better serve the autism community. Ridgemont has deep experience investing in behavioral health and we are excited for the future growth of SPG.

SPG is a leading provider of school and clinic-based behavioral health and therapeutic services to children in California with Autism Spectrum Disorder (ASD), special needs, and developmental/behavior issues. The Company’s experienced staff of behavioral analysts, speech-language pathologists, behavioral therapists and technicians, developmental therapists, and school psychologists play a vital role in improving educational outcomes for special needs children and students.

Ridgemont Equity Partners is a Charlotte-based middle market buyout and growth equity investor. Since 1993, the principals of Ridgemont have invested approximately $4.4 billion. The firm focuses on equity investments up to $250 million in industries in which it has deep expertise, including business and industrial services, energy, healthcare, and technology and telecommunications. “Ridgemont is excited to partner with SPG, whose clinical excellence and strong reputation amongst therapists, schools and families provides a strong foundation for growth,” said Scott Poole, Partner at Ridgemont. “We are looking forward to working closely with the team to help expand SPG’s therapy offering in multiple care settings in order to meet the growing demand within its communities.”

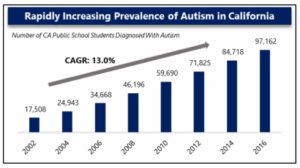

“Demand for autism treatment and special education services continues to be fueled by a variety of factors including the rapid rise in the prevalence of autism, an acute shortage of clinicians in many regional markets, and a growing population of special needs children due to better diagnosis and mounting cognizance among parents and educators of the benefits of intensive therapy and early intervention.” commented Eric Williams, Managing Director of the Philadelphia-based Capstone deal team.

Mark Surowiak, Director at Capstone, added “We are witnessing an unprecedented level of interest in autism treatment providers from both strategic and private equity suitors. Needless to say, it’s hard to imagine a more favorable market.” Capstone has deep experience in the autism therapy space previously representing Invo HealthCare and handling the divestiture of Progressus Therapy for private equity firm Sterling Partners.